Programs & Incentives

Summary of Central Hudson SC1 and SC2 Non-Demand Average kWh Rates

Specific Account Usage Inquiry

Installers

In order to receive funding through NYSERDA, you must use a NYSERDA-approved installer. A list of eligible solar and wind installers can also be found on NYSERDA’s website.

Service Classification

The size of your system and current service classification will determine your new service classification once your generator is interconnected. Some customers may qualify for net metering or remote net metering. If you do not qualify for net metering, please see our electric rate tariffs (leaf 228 for service classification 10 and leaf 272 for service classification 14) for more information.

Community Distributed Generation(CDG)

Log on to the Clean Energy Marketplace and subcribe to a share of a local solar farm.

CDG Allocation Request Form

This form is for use in connection with Central Hudson's Community Distributed Generation Program as contained in General Information Section 46 of P.S.C. No. 15 – Electricity (“Tariff”). Please fill in all of the required fields on the following form, sign and mail them to the address located at the bottom of page. CDG Allocation Request Form

CDG Host Allocation Review and Approval

This document, which was developed and approved by the CDG Billing and Crediting Working Group, provides guidance on timelines for CDG Host Allocation Review and Approval for an initial CDG Allocation Request and modifications to a previously approved form. CDG Host Allocation Review and Approval Guidance Document

CDG Self-Certification

Prior to commencing net metered service under CDG (and annually thereafter), CDG Hosts must self-certify in writing that they will abide by all terms and conditions of General Information Section 46 – Community Distributed Generation of P.S.C. No. 15 – Electricity and the requirements of the PSC that are adopted pursuant to orders issued in Case 15-E-0082 and Case 15-M-0180, as they may be amended or superseded time to time. Here is an "example form" that may be used to fulfill this self-certification requirement.

Central Hudson Net Crediting Manual

Net Metering

Applicability

Net metering is achieved by allowing a customer's meter to spin in the reverse and forward directions. When the customer's generator is producing less energy than the customer is using, the electric meter will measure the energy passing from the utility to the customer and spin in the forward direction. When the customer's generator is producing more energy than the customer is using, the electric meter will measure the excess energy passing from the customer to the utility and spin in the backward direction. The surplus energy is subtracted, or "netted," from the energy supplied by the utility to the customer, thus "net metered." Information on New York State's program, including rebates and incentives, can be found at www.nyserda.ny.gov.

Eligibility

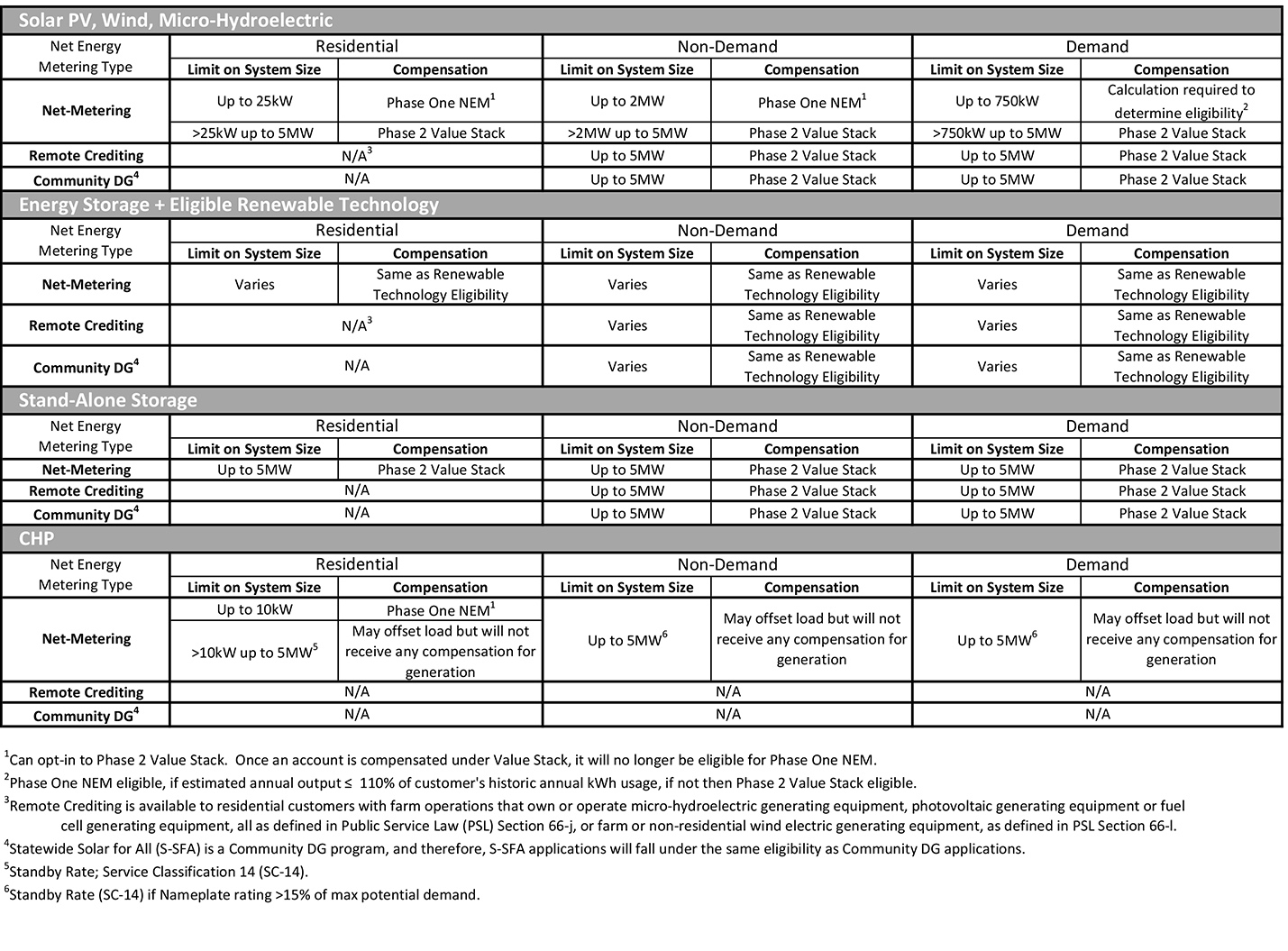

The following chart summarizes New York State law regarding eligibility for net metering:

Click here for a printable version.

Customer Benefit Contribution

As part of the July 16, 2020 Order Establishing Net Metering Successor in Case 15‐E‐0751, the New York State Public Service Commission developed a Customer Benefit Contribution ("CBC") which is a monthly $/kW DC charge to recover public benefit program costs from mass market and small commercial customers that install behind the meter generation and interconnect on or after January 1, 2022.

The CBC charge, which is applicable to customers with on‐site solar, wind or micro‐hydroelectric resources (with demand less than 25 kW), fuel cell, micro‐CHP, and anaerobic digesters will be issued on a separate tariff statement containing the charge by service classification, compensation type and project type. The CBC charge will be updated each January.

The CBC is not applicable to commercial demand‐metered customers with projects under 750 kW, battery storage or projects compensated under Community Distributed Generation (“CDG”) or Remote Crediting programs.

Remote Crediting (RC)

Remote Crediting is a program that enables the generation of renewable energy at one location to be credited to the electricity bill of another. Through this program, a generator host can designate up to ten satellite customers to receive these credits. The host itself must be one of these customers if it wants credits applied to its bill, while the other nine can be unrelated and may include multiple accounts for each satellite customer.

You can also register as a Remote Crediting satellite to receive credits from a Remote Crediting host.

RC satellites can participate in the following:

- Multiple RC projects

- Have onsite generation

RC satellites CANNOT participate in CDG or RNM, or be a RC host.

On Jan. 8, 2021, the Joint Utilities held a technical conference to outline the details of the Remote Crediting Program. You can access the presentation here.

Please see Leaf 163.5.6 of our electric rate tariffs for additional information.

Checklist for Completing Remote Crediting Documents

- Host has allocated a percentage to itself if it intends to use generation for its own load.

- Both host and satellite accounts are active electric accounts within Central Hudson’s service territory.

- Percentage allocations total 100% or less (any generation not allocated to satellites will be banked on the host account).

- The Remote Crediting application is signed by the Central Hudson utility customer.

- A Letter of Authorization is included, for each satellite account, if not same entity as the host.

Wholesale Market Participation

Central Hudson has filed proposed tariff changes effective July 1, 2023 to better allow customers with generating equipment to export to the NYISO through one of its wholesale DER participation models, either directly or through an aggregation. Central Hudson’s proposed tariff changes add Wholesale Value Stack and Wholesale Distribution Service provisions which specify the type of compensation that customers with behind the meter generation can receive from Central Hudson when also exporting to the NYISO. Specifically these changes remove energy and/or capacity compensation from the Value Stack payment made by Central Hudson for customers receiving payment for these components from the NYISO. Additionally, customers exporting to the NYISO are ineligible to participate in Net Energy Metering or Buyback service from Central Hudson. The full filing can be found on the Public Service Commission’s website here: https://ets.dps.ny.gov/ets_web/search/searchSubmissionID.cfm?sub_id=2818291

Billing

If you are not eligible for net metering, there are many other options available to offset your usage. Please see our electric rate tariffs for more information.

Green Power

Explore our Green Power, SavingsCentral and Environment and Sustainability sections for more information on other renewable energy programs that are currently offered in New York State.

Incentives

State and federal incentives exist for a variety of renewable energy sources. In addition, the New York State Energy Research and Development Authority (NYSERDA) offers incentives to install grid-tied solar and wind generators. Please visit their website for more information: